What Is Boat &

Yacht Insurance?

Boat and Yacht Insurance is a type of marine insurance that could protect the insured owner against liability claims from a third party person. Both the boat and yacht insurance have liability coverage — which can cover the insured against a bodily injury and property damages claims from a third party person.

Besides, both insurance policies have maritime areas — this could help the insured if a loss happens and is far from repair.

Understanding Boat & Yacht Insurance

What You Need to Know About Its Differences

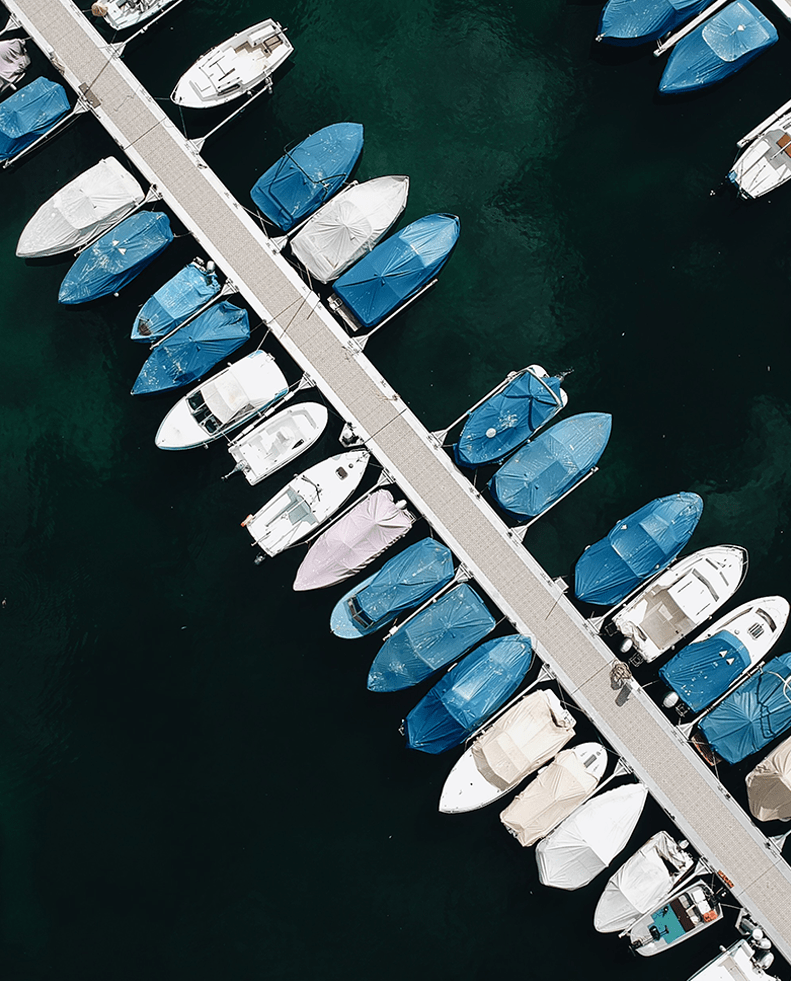

Boats and yachts are a type of watercraft vehicle that has a massive variety of types and sizes. Generally, boats and yachts are smaller than ships and are usually for pleasure use only. While ships are of massive size, they have the capacity to carry a large number of passengers and cargoes. Typical boats that are for pleasure use could be on inland aqueducts — including lakes, rivers, and coastal areas.

On the other hand, a yacht is also a watercraft vehicle. However, the yacht is larger than the boat that can length for more than 26 feet which is the opposite of the boat. Whether you are owning a boat or a yacht, you must protect your hard-earned investment, so if a loss happens, it will not put you in a situation of financial imbalances.

Besides, boat and yacht insurance could generally cover the insured for a year, so you would not need to worry if your watercraft vessel is moored-off in the dock.

Boat Insurance Coverage

Physical damage coverage could help pay for the damages of the watercraft vehicle due to specific perils only. However, some policies can provide an "all-risk" coverage, which means that any loss is applicable for coverage unless the peril is a general exclusion. Typically, covered perils include damages due to severe weather conditions such as rain, hail, wind, and losses due to wave action. Besides, it can also cover damages due to fire, vandalism, and accidents due to collision with submerged objects, other boats, and floating objects.

However, wear and tear are a general exclusion from coverage because it is the duty of the owner to maintain its vehicle.

An Agreed Value policy means that the amount to settle the loss claims is what the insured and the insurance provider agreed or paid upon. However, coverage would only be applicable if the watercraft vehicle deemed a total loss. Besides, under this policy, if the vehicle deems a partial loss — it would be covered by a replacement cost value basis, less the deductible rate.

While, the Actual Cash Value is generally defined as the replacement cost value of the watercraft vehicle, minus its depreciation. Depreciation is the decreased value of the vehicle over a period of time and usually resulting from wear and tear or aging. An Actual Cash Value policy could provide coverage up to its current market value in any event of a total loss.

Personal Property Coverage would cover the insured's personal property including, clothes, sports, and fishing equipment while aboard the boat. Coverage for personal properties has certain exclusions. For example, if the personal property is already insured with another type of insurance, like Homeowners' Insurance. The property wouldn't be applicable for coverage if it is insured on another policy.

Liability Coverage is one of the most important coverages for the insured boat and yacht owners. This coverage would cover the insured against bodily injury and property damages claims from a third party person — if the insured is legally liable for the claim.

Liability Coverage would cover both the necessary cost for settling the claims and legal fees, in case the third party person files a legal claim against the insured. For further illustration, suppose that the insured boat accidentally hit another boat while fishing and the other boat's owner demands a payment for the repair. With this type of incident, the insured would be covered from liabilities.

Under the Oil Pollution Act of 1990, the owners of the vehicle would be responsible for any liability or clean-up expenses — resulting from water pollution brought about by their vehicle. In addition, other policies also offer liability coverage for their shore-based employees in case they caught an accident while onboard the boat.

Uninsured Boater Coverage could help pay for the medical payments if he caught an accident whereas the person who is liable for the accident does not have liability insurance. Also, it could help pay for the damages if the liable person does not have enough insurance to cover all the damages.

Towing and Assistance Coverage covers the insured in case the boat of the insured is mechanically disabled and needs immediate assistance. This could reimburse the costs for assisting an immediate service to your vehicle, including fuel and oil delivery, and for towing to a nearby qualified repair shop. Besides, it could also reimburse the cost of any emergency labor that is made to the watercraft vehicle.

An Uninsured Motorist is a part of an auto insurance policy that could help pay for the insured's medical expenses. Also, it could pay for the repair of the insured's vehicle if the driver at-fault is uninsured.

Underinsured Motorist coverage is the same as the Uninsured Motorist Coverage. However, the coverage could only kick in once the policy of the person at fault reaches its limit. And would not be able to accommodate all the expenses for the damages to the insured.

Towing and Labor Coverage pays the cost of towing your car to a repair shop if you are unable to drive it. Also, it covers a fixed amount of required labor charges at the breakdown stage. Therefore any excess expenses for towing your vehicle will be the insured's responsibility.

Other Types Of Boat & Yacht Insurance

Boat Club Insurance would cover all the members of the boat club while the member is utilizing a boat. This insurance would cover the member's from property damages and liability claims from a third party person.

Hull Insurance pays for the damages to the boat of the insured that are due to the properties of the others. It could help pay for the repair of the vehicle.

This insurance could typically cover all types of perils unless the risk is a general exclusion from coverage. It can cover the damages caused by reef damage, freezing, ice damage, and mechanical breakdown, which are not applicable for coverage from a standard boat insurance policy.

This type of policy would help the insured pay for the damages to the travel equipment and other types of equipment that are used for fishing tournaments.

As of 2015, it is said that recreational boats and yacht accidents increased from the prior years, with a total of more or less 680 boating accidents. Furthermore, based on the research done by Florida Fish and Wildlife Conservation Commission Annual Report, the common cause of boat and yacht accidents are boat overloading and machinery failure.

With these happenings, could you afford to pay for all the cost of repair and damages to your boat? Also, could you afford to pay for the damages to the boat of the others? Should you cause damage to their boats?

Well, we can guarantee you that you don't. Repairing a part of a vessel or yacht could cost you more than you imagine, that's why InsureHopper is here to help you with that. Our affiliated insurance agents can help you find protection that can surely cover the losses that you might encounter in the future.

Get a Boat Insurance Quote and Yacht Insurance Quote and we'll let you share your risks. Just fill out the form to get an accurate estimation of your premium.